A new study examining what consumers think of technology in financial services finds the majority of Americans (88 percent) want technology to complement, not replace, the assistance of a human financial advisor.

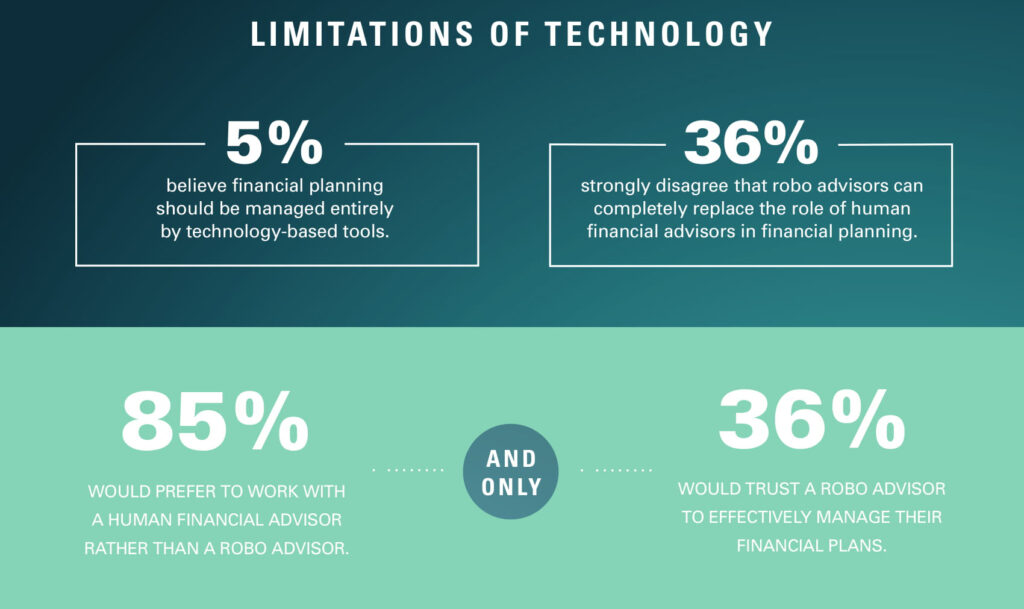

Only five percent state financial planning should be managed entirely by technology-based tools. The study was commissioned by MDRT and conducted online by The Harris Poll among over 2,000 U.S. adults.

Ross Vanderwolf

“Due to their experienced insight, expertise and personal touch, human financial advisors are still in high demand amidst the growth of robo technologies,”

said Ross Vanderwolf, CFP, MDRT President.

“Despite that consistent demand, this study shows that it behooves advisors to continue to integrate innovative technology into their practice for continued growth and success.”

While 83 percent of Americans would trust a human financial advisor to effectively manage their financial plans, only 36 percent would trust the job to a robo advisor. Moreover, 85 percent say they prefer working with a human financial advisor rather than a robo advisor. In addition, 36 percent strongly disagree that robo advisors could completely replace the role of human financial advisors in financial planning.

The Human Advantage

The Human Advantage

The top benefit Americans cite for working with a human financial advisor over a robo advisor is the opportunity to build a trusting relationship (65 percent), followed closely by the high level of human interaction (58 percent) and ease of communication (52 percent). The main concerns of working with a human financial advisor are cost (47 percent), response time (32 percent) and accuracy of assessments (31 percent).

The top benefit of working with a robo advisor over a human advisor, according to Americans, is minimized risk of human error (49 percent). The main concerns are lack of two-way conversational communication (58 percent), minimal human interaction (48 percent) and breach of data, including personal (46 percent) and financial (44 percent).

Generational Preferences

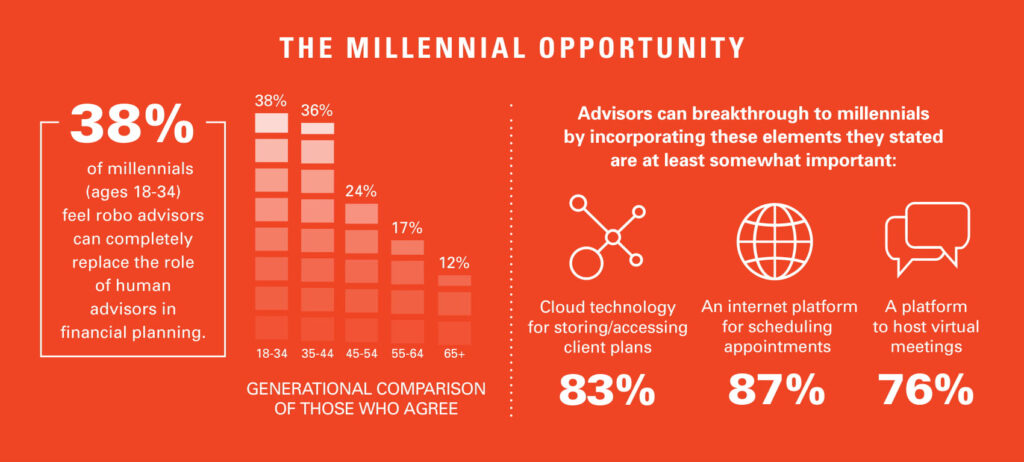

When it comes to hiring a financial professional or using technology, millennials (ages 18-34) are split. About half (52 percent) would trust a robo advisor to effectively manage their financial plans, while the remaining 48 percent would not. Millennials are also twice as likely as some of their older counterparts (ages 45+) to agree that robo advisors could completely replace the role of human advisors in financial planning (38 percent vs. 17 percent).

Of millennials who currently use a human financial advisor, the majority prefer their advisor utilize various technology-based tools to manage their business. An internet platform for scheduling appointments is important to 84 percent of millennials with an advisor and 78 percent state a platform to host virtual meetings is a priority.

Older Americans (age 45+) are far less likely than millennials to trust a robo advisor to effectively manage their financial plans (24 percent vs. 52 percent). Only 17 percent of Americans age 45+ agree that robo advisors could completely replace the role of human advisors, and 44 percent of those age 65+ say there is no benefit of working with a robo advisor over a human advisor.

Older Americans (age 55-64) who work with a human advisor also value their advisor utilizing various updated technology-based tools to manage their finances. More than three out of four consider cloud technology for storing/accessing client plans (80 percent) and an internet platform for scheduling appointments (77 percent) valuable tools for their advisors to incorporate.

Featured image credit: MDTR

Schreibe einen Kommentar