Exberry has been appointed by London Derivatives Exchange (LDX) to provide matching engine technology. The new technology partnership will enable LDX to launch global markets and cover a wide spectrum of asset classes.

Digital assets have emerged as an attractive new investment class, especially since the pandemic, and demand for alternative secondary market trading opportunities is increasing. Exberry’s infrastructure overcomes the limitations of current exchange technology – it delivers a platform designed to help any asset class launch markets, pivot, and scale.

LDX will leverage Exberry’s platform to provide technology for a wide variety of asset classes – from new security tokens, to traditional assets such as commodities or derivatives. Exberry’s exchange infrastructure will help LDX to deliver initiatives designed to improve the end-to-end investment model and implement processes that will drive down costs and increase operational efficiencies, to the benefit of the end investor. Exberry was chosen for its modern, scalable, easily-deployed system and its client focused engagement model.

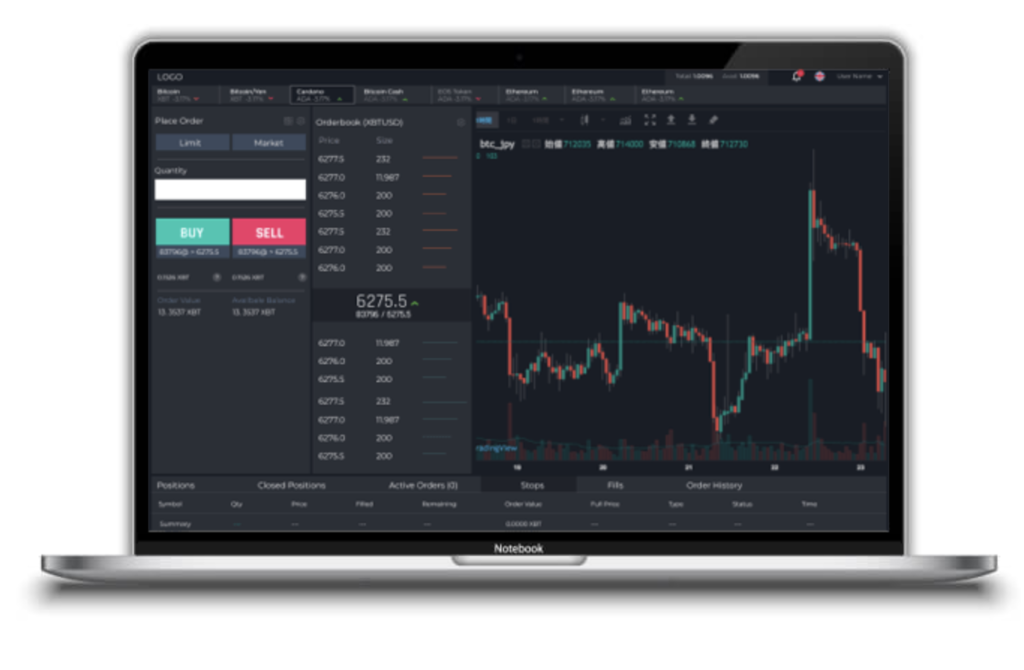

Exberry delivers an exchange matching engine delivered as a “Matching Engine-as-a-Service” concept, allowing LDX and their clients to reap the full benefits of an exchange-grade solution that can be cloud-based or on-premise.

Schreibe einen Kommentar